Capital Allowance for Motor Vehicle

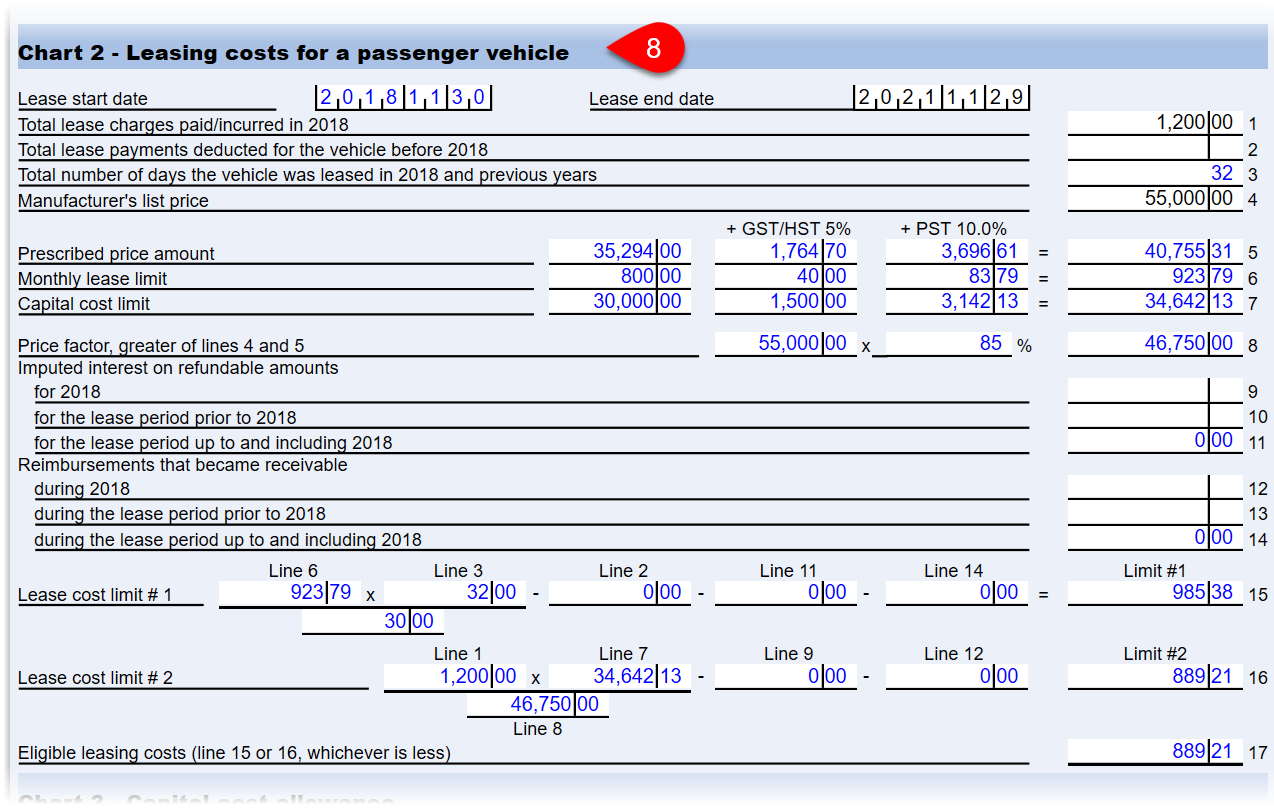

Note that goods and services tax GST and provincial sales tax PST or harmonized sales tax HST should not be included when calculating the cost. Enter the amount you can deduct on the Artists employment expenses line of Form T777 Statement of Employment Expenses.

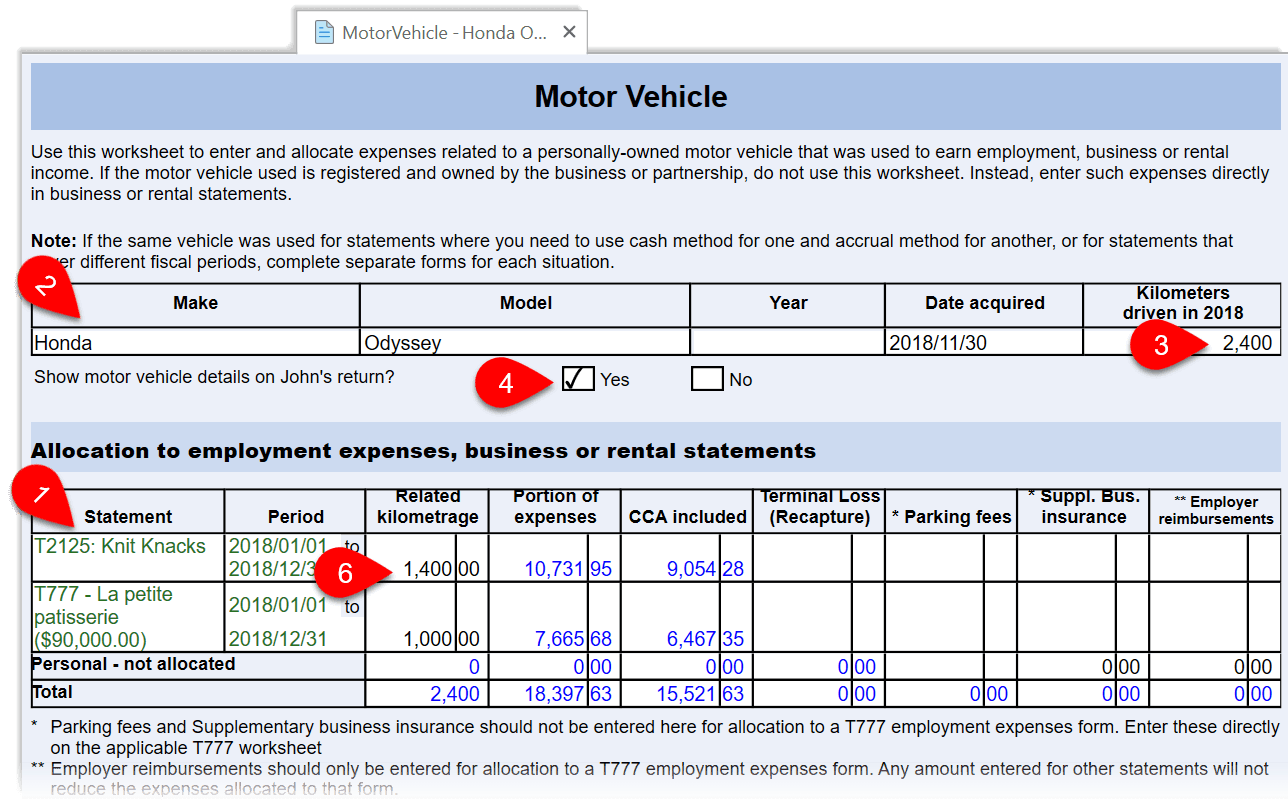

Motor Vehicle Expenses Taxcycle

If this is your first year of business and your fiscal period is less than 365 days you must prorate your CCA claim based on the number of days you were actually operating during the year.

. Old and used diesel driven motor vehicles of engine capacity of 1500 cc or more and of length of 4000 mm Explanation. Line 22900 was line 229 before tax year 2019. Eligible for capital allowance.

The vehicle is used only for the official purpose. In a block of four years one can claim LTA for two times only. Capital allowances cannot be claimed on the costs of private cars eg.

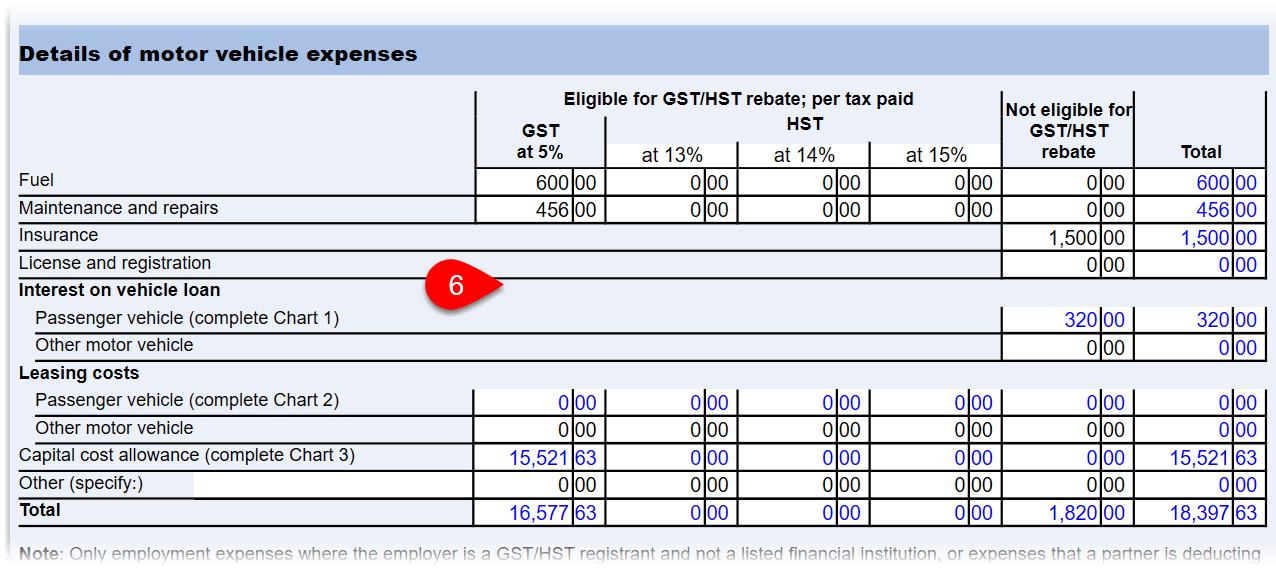

Motor vehicle for Capital Allowance is classified into 2 categories. Information on motor vehicle expenses you can deduct as a salaried employee if you meet certain conditions. For your motor vehicle.

If the vehicle is used for the official purpose the amount is treated as non-taxable with the condition of maintaining proper records in Logbook of the vehicle. Any vehicle not classed as a motor vehicle The Canada Revenue Agency provides a chart of vehicle definitions for vehicles bought or leased after June 17 1987 and used to earn business income. The Leave Travel Allowance exemption is available for two children only who are born after October 1 1998.

The Car Allowance Rebate System CARS colloquially known as cash for clunkers was a 3 billion US. Class 101 30 If you own a second vehicle that was purchased. Conveyance Allowance for the purpose of commuting between place of residence and place of duty.

Renew vehicle insurance online from PolicyBazaar to get the best comprehensive policy for a car bike and commercial vehicles from various motor insurance companies in India. There are two possibilities. Passenger private vehicle.

If one has not claimed LTA in a particular block year then it can be carried to the next block year and can be used in the 1 st year of the next block only. Capital allowance is only applicable to business activity and not for individual. The program was promoted as a post-recession stimulus program to boost auto sales while putting.

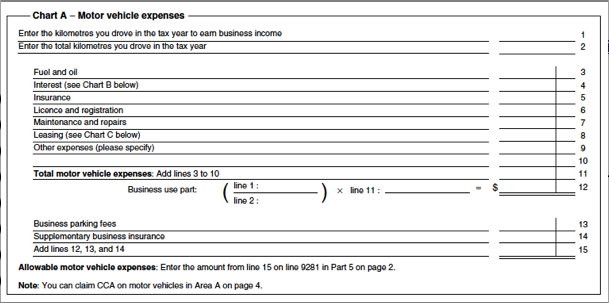

If the motor vehicle qualifies for capital allowances the expenditure incurred on obtaining the COE may be included when claiming capital allowances on the. Types of motor vehicles The type of motor vehicle you drive can affect how you calculate your claim. Paid on a cents per.

Q-plated and RU-plated cars. Two fold-away bench seats stored on lateral penal in the rear section of the vehicle 4. S-plated cars and business cars eg.

Federal scrappage program intended to provide economic incentives to US. Capital Cost Allowance CCA is a set of rates stating the amount you can claim each year on a depreciable property used for business activities. Capital cost allowance for your motor vehicle read Chapter 9 If you have expenses you cannot claim because of the 20 or 1000 limit you can deduct them from artistic income you earn in a future year.

Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is. INR 19200 per year INR 1600 per month. Car A car is a motor vehicle that is designed to carry.

The total of all of the amounts in Column 9 is entered on line 9936 Capital cost allowance CCA in Part 5 of Form T2125. Two doors plus a swing-out rear door Three wheel motor Tricycle with cabin for carrying passengers is 8703 Duty is calculated according to cubic capacity cc Three wheel motor with bucket or container for cargo is 8704 Three wheel motor for the aged 8703. Car allowance policy for employees.

No Export and Import HSN Codes Prescribed. Generally your capital gain or capital loss is the difference between. A load of less than one tonne and fewer than 9 passengers.

The vehicle is used for both personal as well as official. You must declare the amount of any capital gain or capital loss you make when you dispose of a capital asset such as an investment property shares or crypto assets. Conveyance allowance for commuting between place of residence to the place of duty for physically disabled or.

Capital Allowance Claim for Motor Vehicles. A motor vehicle is either a car or an other vehicle. Eligible interest you paid on a loan used to buy the.

Your assets cost base what you paid for it your capital proceeds the amount you receive. Residents to purchase a new more fuel-efficient vehicle when trading in a less fuel-efficient vehicle. Commercial vehicle van lorry and bus What is eligible for capital allowance.

A motor vehicle allowance can be paid on the basis of an amount per business kilometre travelled by the employee or as a regular flat or fixed amount. Motor vehicles including some passenger vehicles can be included in this class. Basic Accessories and registration fees which is required by the road transport department RTD.

Kindly use Chrome Mozilla Firefox or Microsoft Edge for this site. The exempt rate for overnight accommodation allowances is the total reasonable amount for daily travel allowance expense using the lowest capital city for the lowest salary band for the. For the purposes of this entry the specification of the motor vehicle shall be determined as per the Motor Vehicles Act 1988 59 of 1988 and the rules made there under.

2004 but before 2005 and you made an election. Many four-wheel drives and some. Motor vehicle allowance paid on a per kilometre basis Section 22 of the Fringe Benefits Tax Assessment Act 1986 the FBT Act generally exempts an expense payment benefit if it is a reimbursement of car expenses of a car owned or leased by an employee that is calculated by reference to the distance travelled by the car ie.

Motor Vehicle Expenses Taxcycle

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

No comments for "Capital Allowance for Motor Vehicle"

Post a Comment